Former Federal Reserve chairman: “We need the gold standard more than ever”

According to Alan Greenspan, the USA is facing financial problems. The country may fail to comply with its reformation plans because the budget for them has ran out of funds.

Is the gold standard the miracle everybody is waiting for?

The former Fed chairman is a strong supporter of the gold standard. He believes that, if all central banks agree to go back to it, it would help to reduce the fluctuations of exchange rates and to limit debts.

The idea of coming back to the gold standard was also mentioned in 2016's UK referendum. The country could foresee the dangers of a possible debt crisis with the EU. In fact, many of the financial issues that European countries face could have been avoided by sticking to a single standard.

Mr. Greenspan's forecasts regarding the US policy

Serious debt problems may shake the country. Even though the White House plans to revise taxes and tariffs on imports and exports, the reformation action plan costs $1 trillion.

“If the gold standard were in place today, we would not have reached the situation in which we now find ourselves. […] We would never have reached this position of extreme indebtedness were we on the gold standard, because the gold standard is a way of ensuring that fiscal policy never gets out of line,” said Mr. Greenspan.

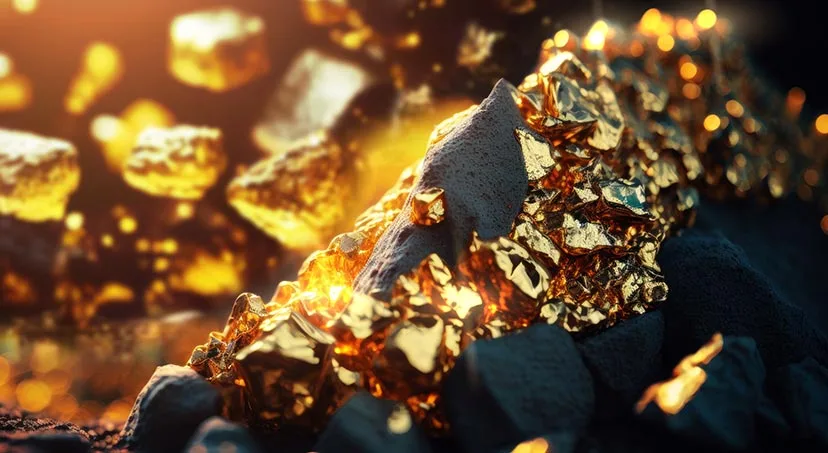

Buying gold is the best we can do

Alan Greenspan added that: “investment in gold now is insurance: it’s not for short-term gain, but for long-term protection.”

That is why the Global InterGold Online Gold Shop makes gold available for just about everyone. Protect your financial future with this precious metal!

Learn also how to earn thousands of euros per month while creating your personal gold reserves here.